Deposit frequency reveals how often VIP players fund their accounts, offering insights into engagement, spending habits, and churn risks. Despite making up just 2% of users, VIPs drive 83% of deposits. Tracking deposit patterns helps operators identify steady players versus sporadic high-rollers, enabling tailored retention strategies. Key points include:

- RFM Analysis: Tracks Recency (last deposit), Frequency (how often), and Monetary value (total deposits). High-frequency players need consistent engagement tactics; high-value, irregular players may need loyalty perks.

- Tools: Platforms like InTarget monitor activity and automate responses. Starting at $800/month, it offers real-time alerts and AI-driven insights.

- Retention: Sudden changes in deposit habits signal churn risks. Personalized email marketing for iGaming or VIP outreach can re-engage players.

- Insights: Frequent small deposits suggest consistent engagement, while sporadic large ones indicate high risk tolerance. Both require tailored approaches.

Understanding deposit frequency not only boosts retention but also optimizes loyalty programs and revenue.

Metrics and Tools for Tracking VIP Deposit Frequency

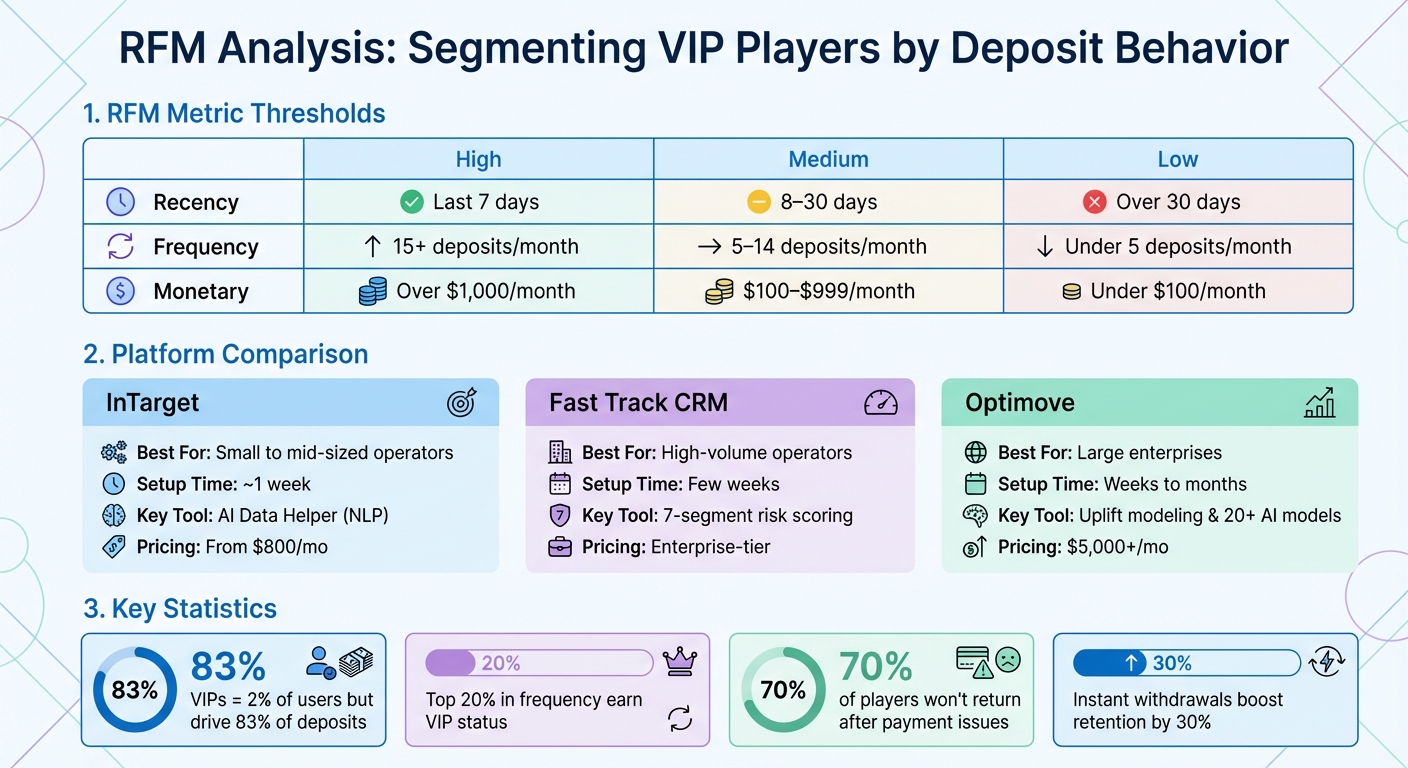

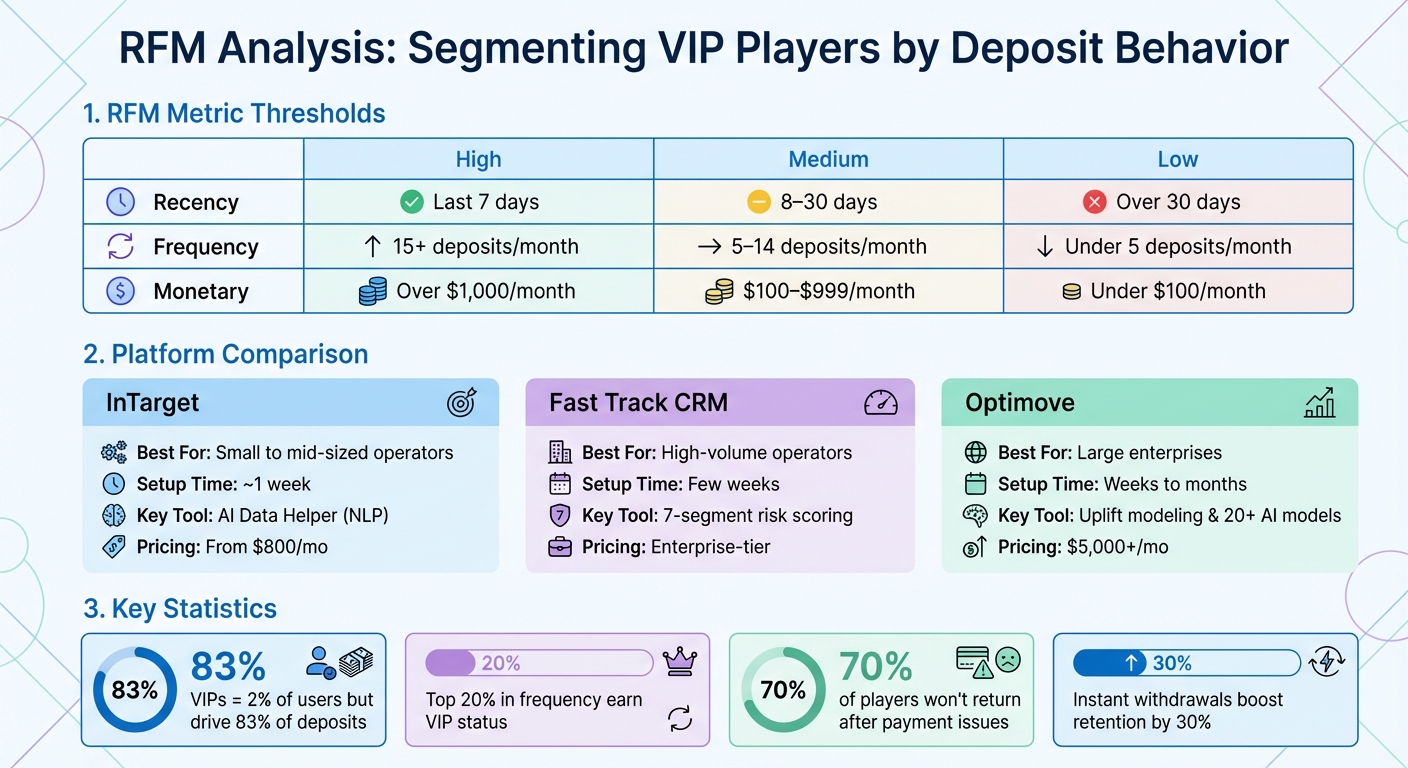

RFM Analysis Metrics for VIP Player Segmentation in iGaming

Understanding deposit frequency isn’t just about tallying transactions. It’s about using data-driven frameworks and real-time tools to decode VIP behavior and act before engagement wanes.

RFM Analysis for VIP Players

RFM analysis focuses on three key metrics to evaluate VIP behavior: Recency (how long since the last deposit), Frequency (how often deposits are made), and Monetary (total deposit value). This method allows operators to segment players based on their actual activity instead of relying on intuition.

- Frequency offers insights into engagement. For instance, a VIP making multiple $100–$200 deposits monthly shows consistent activity, while a player depositing $10,000–$50,000 sporadically represents a different kind of value. Both are important, but they require tailored strategies. High-frequency players, for example, are ideal for personalized offers to maintain their steady engagement.

- Recency acts as a warning signal. If a player who typically deposits every few days suddenly goes silent for over 30 days, it’s time to intervene. Short deposit intervals suggest high engagement, while longer gaps can indicate a risk of churn.

- Monetary value tracks overall spending. Players are often scored 1–5 on each RFM metric, with the top 20% in frequency earning VIP status. A player who deposits $10,000 irregularly but scores high on Monetary may need loyalty incentives to increase consistency. Meanwhile, high-frequency but lower-spending players might benefit from upselling campaigns.

| RFM Metric | High | Medium | Low |

|---|---|---|---|

| Recency | Last 7 days | 8–30 days | Over 30 days |

| Frequency | 15+ deposits/month | 5–14 deposits/month | Under 5 deposits/month |

| Monetary | Over $1,000/month | $100–$999/month | Under $100/month |

With these insights, platforms like InTarget can turn raw data into actionable strategies.

Platforms for Monitoring Deposit Frequency

While RFM analysis helps segment VIPs, specialized platforms enable operators to act on this data in real time. Tools like InTarget are designed for small to mid-sized iGaming operators, offering a streamlined way to monitor VIP activity without the complexity of enterprise systems.

InTarget integrates quickly – usually within a week – and includes features like an AI Data Helper. This tool allows marketing teams to ask natural language questions like, “Which VIP players haven’t deposited in the last 10 days?” and receive instant, actionable insights.

Unlike pricier options such as Optimove (starting at $5,000+/month with lengthy setup times) or Fast Track CRM (geared toward enterprise-level budgets), InTarget starts at $800/month with transparent pricing. It tracks key metrics like average monthly deposits, play frequency, and churn risk, while automating responses like email, SMS, or push notifications. For example, if a high-value player’s recency score drops, the system can automatically send a personalized reload bonus offer to re-engage them.

| Feature | InTarget | Fast Track CRM | Optimove |

|---|---|---|---|

| Best For | Small to mid-sized operators | High-volume operators | Large enterprises |

| Setup Time | ~1 week | Few weeks | Weeks to months |

| Tool | AI Data Helper (NLP) | 7-segment risk scoring | Uplift modeling & 20+ AI models |

| Pricing | From $800/mo | Enterprise-tier | $5,000+/mo |

The goal is to shift from reactive to proactive strategies. When deposit frequency data seamlessly integrates into a CRM capable of triggering instant actions, operators can address behavioral changes as they happen – keeping VIP players engaged before they drift away.

What Research Shows About VIP Deposit Patterns

It’s fascinating to note that just 2% of players can generate over half of an iGaming platform’s total revenue. This underscores the importance of understanding high-value deposit behaviors to fine-tune retention strategies.

Frequent Small Deposits vs. Irregular Large Deposits

VIP players exhibit distinct deposit habits. Some prefer frequent, smaller deposits, creating a steady pattern that often reflects long-term loyalty and deep engagement. Others, however, make occasional but very large deposits in a single transaction, only to disappear for a while. Both behaviors are valuable but stem from different motivations.

"When you see players making larger and more frequent deposits, so you know you’re giving them an experience they love and want more of. On the other hand, if average deposits start to drop off, it’s a sign we need to make some changes."

- Elizabeth Sramek, Scaleo

Frequent depositors often seek consistent entertainment, while high-volume depositors may expect exclusive perks or faster services to keep them engaged. These patterns highlight the need for tailored strategies to cater to their unique preferences. The way deposits are spaced out also plays a significant role in understanding engagement, as discussed below.

Time Between Deposits and Player Engagement

The time between deposits is a key indicator of a VIP player’s engagement level and potential risk of churn. Many VIPs follow predictable deposit schedules, such as adding funds on the same day each week. A sudden change in this routine – like a longer gap – can signal trouble.

On the flip side, shorter deposit intervals might indicate "heating up" behavior, where a player is highly engaged and might respond well to upgrades or exclusive offers. However, longer gaps between deposits could suggest declining interest or issues with processes like withdrawals or bonus claims.

Payment experiences also play a critical role. Research shows that 70% of players won’t return if they face frustrating deposit or payment issues. In fact, 52% of bettors have encountered delays, which account for 17% of sign-up drop-offs. On the other hand, platforms offering instant withdrawals often see a 30% boost in retention, as quick payouts build trust and encourage continued deposits.

Keeping an eye on deposit patterns is crucial. If a VIP player misses their usual deposit day, it’s time to act. Starting with lifecycle marketing automation and escalating to a personal call from a VIP specialist can make all the difference in preventing churn. Early intervention is key.

How to Use Deposit Frequency Data

Understanding deposit frequency isn’t just about tracking numbers – it’s about using that data to create meaningful connections with VIP players. By analyzing these patterns, you can craft targeted campaigns, refine loyalty programs, and even prevent player churn. Let’s break it down.

Tailored Messages and Offers

VIP players expect more than generic promotions – they want experiences that feel custom-made for them. For instance, if a player consistently deposits a specific amount every Saturday, your CRM can pick up on this habit and trigger a well-timed offer, like a deposit match or access to an exclusive tournament, just before their usual deposit day.

Platforms such as InTarget make this process seamless. With instant access to deposit patterns, your team can launch highly targeted campaigns. If a frequent depositor suddenly stops their usual activity, automated triggers can send reminders or bonuses. And when automation falls short, it’s time for personalized VIP outreach. Tailor your approach: frequent depositors might appreciate reload bonuses, while high-volume depositors may expect perks like faster withdrawals or dedicated support.

This level of personalization isn’t just nice to have – it’s essential for building loyalty programs that resonate with VIP players.

Optimizing Loyalty Programs

Loyalty programs that ignore deposit frequency miss a golden opportunity to engage high-value players. A player who deposits $100 weekly for months deserves a different reward structure than someone who makes a one-time $5,000 deposit. Aligning rewards with deposit behavior keeps players invested and feeling valued.

Use deposit data to define tier thresholds that upgrade players automatically. For example, if a player transitions from monthly to weekly deposits, that shift could unlock a new tier or bonus. Industry data shows that loyalty programs built on these insights can boost revenue retention by 20% to 35%.

Track which rewards drive the most engagement and tweak your program accordingly. Deposit frequency provides a clear signal of player engagement, and rewarding the right behaviors ensures those habits stick.

But loyalty isn’t just about rewards – it’s also about catching early signs of disengagement.

Predicting and Preventing Churn

Deposit frequency is one of the most reliable indicators of potential churn. For example, a UK gaming operator used machine learning to analyze deposit patterns and reduced player churn by 10% while increasing average player value by 5% in just four months.

Set up real-time alerts for changes in deposit habits. If a VIP who usually deposits every Tuesday skips two consecutive weeks, that’s a warning sign. Automated offers can re-engage them, but if those fail, escalate to personalized outreach. Companies like Casumo have leveraged behavioral data tools to improve response times for player issues, cutting resolution times by 87% – a key factor in maintaining VIP satisfaction.

AI tools can take this a step further by optimizing when and how to use incentives. For instance, if a player is likely to deposit without a bonus, holding back the incentive saves costs while still encouraging engagement. Personalized retention strategies powered by AI have reduced churn rates by 17% to 41%, proving that smart, data-driven approaches can protect your bottom line while keeping players engaged.

Key Takeaways

Deposit frequency provides valuable insights into VIP behavior, directly influencing your revenue. While VIPs typically make up just about 2% of your player base, they contribute a massive 50–60% of your casino’s Gross Gaming Revenue. Knowing how often and when these players deposit can shape strategies to keep them engaged and reduce the risk of losing them.

The patterns behind deposits tell a story. Frequent, smaller deposits often reflect steady engagement and a willingness to take calculated risks. On the other hand, sporadic, larger deposits highlight high rollers who likely have unique preferences and expectations. Shorter gaps between deposits can also signal players with higher risk tolerance and potential for growth.

Acting on these patterns quickly is crucial. Tools like InTarget allow small- and mid-sized operators to tap into deposit frequency data with features like real-time monitoring and automated triggers. For instance, if a VIP’s deposit frequency drops by 50%, the system can send automated alerts, enabling operators to initiate personalized outreach. This makes it easier to re-engage players and roll out targeted campaigns promptly.

FAQs

How does deposit frequency influence the retention of VIP players?

Deposit frequency is a key factor in understanding and retaining VIP players. By analyzing this data, operators can craft customized offers, provide well-timed engagement, and apply focused loyalty strategies. These efforts not only improve the overall experience for players but also increase their lifetime value and strengthen their ongoing loyalty.

Recognizing deposit trends allows operators to spot chances to reward top-tier players, reduce the risk of churn, and build lasting connections. This proactive method ensures VIP players feel appreciated and stay actively involved over the long term.

What is RFM analysis, and how can it help segment VIP players?

RFM analysis is a powerful tool for segmenting players based on three main factors: Recency (when they last made a transaction), Frequency (how often they transact), and Monetary value (how much they spend). This method allows operators to pinpoint high-value VIP players and adjust marketing efforts to match their specific behaviors.

By recognizing these patterns, operators can craft loyalty programs that feel more personal, boost retention rates, and increase the overall lifetime value of players. For instance, RFM can help identify VIP players who make frequent deposits but haven’t been active recently. With this insight, operators can entice them back with tailored offers or exclusive rewards.

Why is it important to monitor VIP deposit patterns in real time?

Keeping a close eye on VIP deposit patterns in real time is crucial for spotting any changes in player behavior, like shifts in how often or how much they deposit. This quick insight gives operators the chance to step in with tailored offers or incentives, making sure these high-value players feel appreciated and stay engaged.

Using real-time data, operators can tackle potential concerns – like a drop in activity – before they escalate. This strategy not only helps maintain strong relationships with VIP players but also boosts their overall value over time.