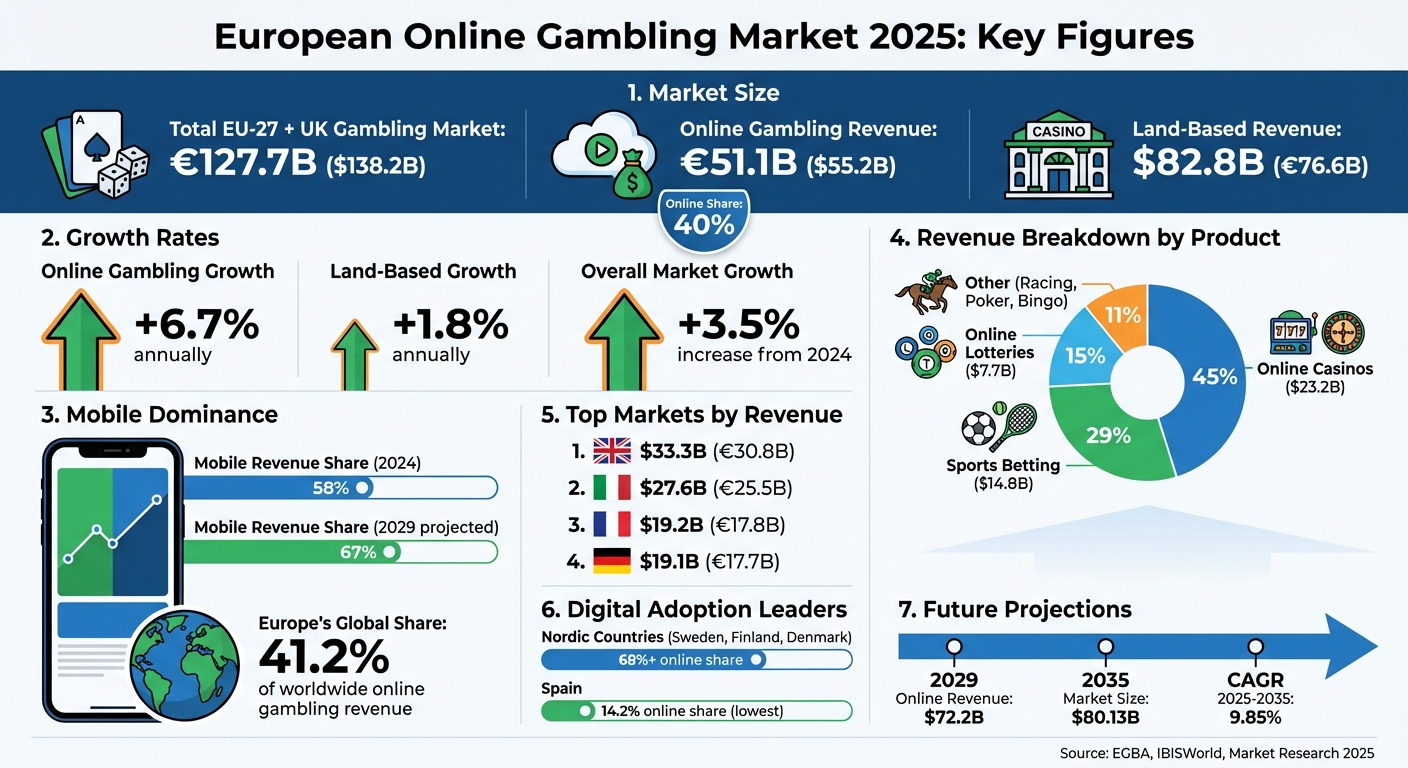

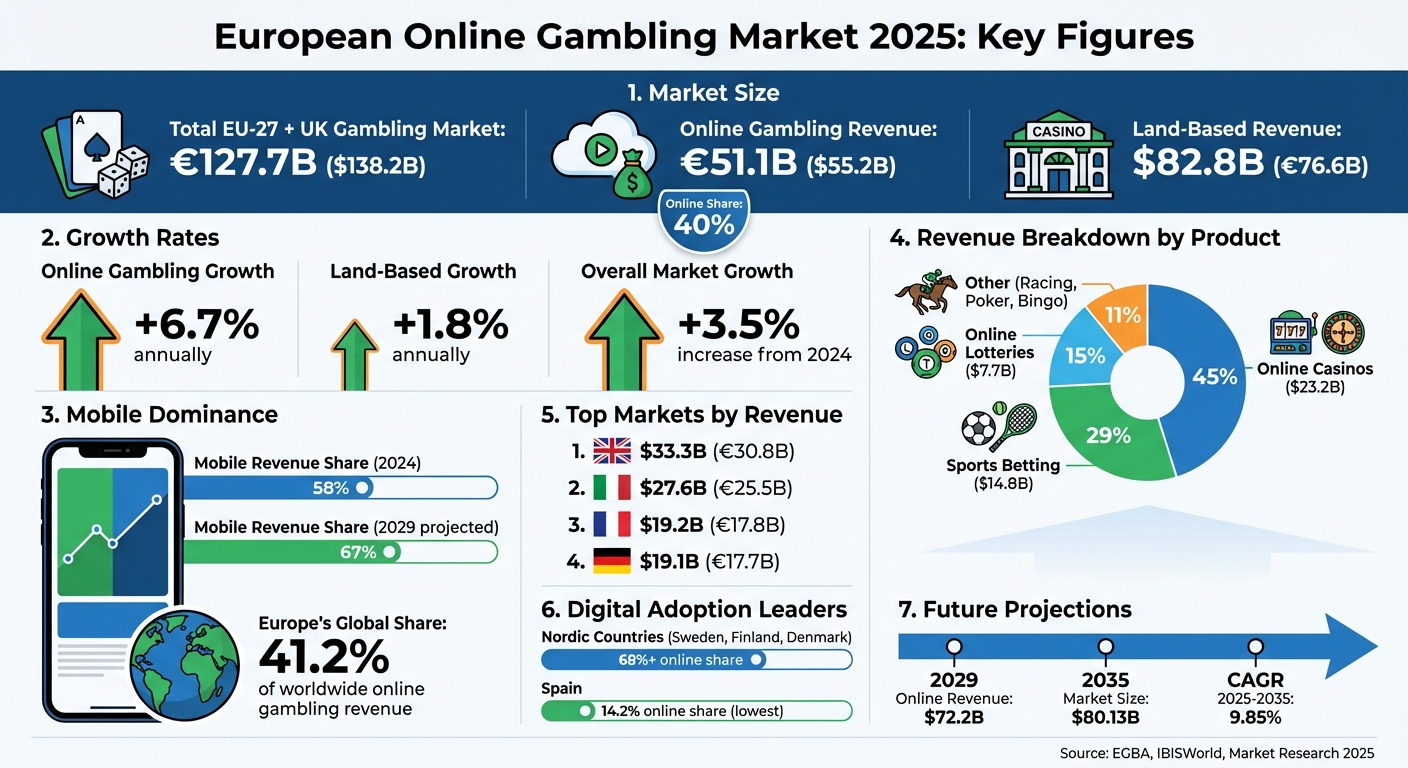

The European online gambling market is booming. By 2025, it will make up 40% of the total gambling market, generating €51.1 billion ($55.2 billion) in revenue. The total gambling market across the EU-27 and the UK is projected at €127.7 billion ($138.2 billion). Key drivers include mobile usage, 5G networks, and AI-powered personalization tools.

Here’s what you need to know:

- Online Revenue Growth: Online gambling revenue is growing at 6.7% annually, compared to just 1.8% for land-based gambling.

- Mobile Dominance: Mobile devices accounted for 58% of online gambling revenue in 2024, projected to hit 67% by 2029.

- Regional Leaders: The UK, Italy, France, and Germany dominate revenue, while Nordic countries lead in digital adoption.

- Regulatory Shifts: Stricter rules in Germany, the UK, and other nations are increasing compliance costs, while France debates legalizing online casinos to curb its €1.5 billion ($1.6 billion) black market.

- Tech Trends: AI and blockchain are reshaping operations, improving risk management, and enabling faster, more secure transactions. These advancements also allow operators to implement sophisticated lifecycle marketing automation for iGaming to retain players in a competitive market.

European Online Gambling Market Statistics 2025: Revenue Growth and Key Trends

European Online Gambling Market Overview

Europe’s gambling market is in the midst of a steady transformation, with revenues projected to hit $138.2 billion (€127.7 billion) in total gross gaming revenue by 2025. This marks a 3.5% increase from the $133.5 billion (€123.4 billion) forecasted for 2024. A big driver behind this growth? The rapid expansion of digital platforms, which are reshaping how gambling services are delivered and consumed.

Market Size and Growth Rates

The numbers tell an interesting story. While the overall market is growing at a modest pace, online gambling is racing ahead. Online platforms are expected to generate $55.2 billion (€51.1 billion) in 2025, up from $51.8 billion (€47.9 billion) in 2024 – a 6.7% year-over-year growth rate. By comparison, land-based gambling is growing much slower, at just 1.8% annually, with revenues projected to reach $82.8 billion (€76.6 billion) in 2025.

Europe continues to dominate the global online gambling scene, contributing 41.2% of worldwide online gambling revenue. Among individual markets, the UK leads the pack, bringing in $33.3 billion (€30.8 billion) in total revenue for 2024. Italy follows with $27.6 billion (€25.5 billion), then France at $19.2 billion (€17.8 billion), and Germany close behind at $19.1 billion (€17.7 billion). The Nordic countries – Sweden, Finland, and Denmark – boast the highest rates of digital adoption, with over 68% of their gambling revenue coming from online platforms. On the other hand, Spain lags far behind, with just 14.2% of its gambling revenue sourced digitally.

These regional differences highlight the importance of understanding local markets when analyzing the sector’s product-specific trends.

Online Gambling Revenue Breakdown

When it comes to online gambling, casinos dominate the scene, accounting for 45% of revenue at $23.2 billion. Sports betting follows at 29% ($14.8 billion), with online lotteries contributing 15% ($7.7 billion). The remaining 11% comes from horse racing, poker, and bingo combined.

Preferences vary widely across countries. For example, Malta and Estonia lean heavily toward online casinos, while Cyprus and Slovakia show a stronger preference for sports betting. This diversity underscores the need for operators to customize their offerings to fit local tastes. A one-size-fits-all approach simply won’t work in such a varied market, making localized strategies key to success. These insights are invaluable for shaping CRM strategies that align with regional preferences.

Key Trends Shaping the Market

Mobile Gambling Growth

Mobile devices are driving Europe’s online gambling boom, reshaping how players interact with betting platforms. Smartphones and tablets are now central to the experience, with features like real-time betting, push notifications, and one-click payment systems fueling a surge in user activity.

Take Denmark as an example. In 2024, the country’s gross gaming revenue hit roughly 7.27 billion Danish kroner (around $1.02 billion), representing a 6.9% increase. Notably, two-thirds of this growth came from sports betting on mobile devices. Experts predict mobile gambling will continue to grow faster than desktop usage through 2030, thanks to these seamless engagement tools.

"Digital uptake has propelled demand for online gambling. Robust internet connectivity and the prevalence of smartphones have made online gambling and betting more accessible." – IBISWorld

To stay competitive, operators are focusing on mobile-first strategies. Features like same-day payouts, immersive live dealer experiences, and freemium models with built-in ads are becoming industry standards. This mobile-centric evolution varies by region, shaping not just revenue streams but also product offerings and regulatory responses.

Regional Market Differences

Europe’s gambling market is anything but uniform, with mobile adoption playing a key role in regional variations. The UK and Nordic countries are leading the charge, where online gambling accounts for over 50% of total gambling revenue. In 2024, countries like Sweden, Finland, and Denmark saw online shares surpass 68%. Meanwhile, in places like Germany, Italy, and Spain, online channels made up less than 25% of total gambling activity in 2023.

Regulatory policies further complicate the landscape. For instance, Germany recently raised its gross gaming revenue tax from 5.3% to 7%, alongside imposing strict stake and deposit limits. These changes are pushing operators to develop compliance-friendly products and emphasize trust in their branding. In France, the ban on online casino games has given rise to a $1.6 billion (€1.5 billion) black market, sparking debates about legalization as a way to recover lost tax revenue. This fragmented environment means a one-size-fits-all approach won’t work. Success depends on tailoring strategies to local regulations, player behaviors, and market maturity, ensuring email marketing for iGaming and customer relationship management align with regional needs.

Regulatory Landscape and Challenges

Major Regulatory Changes in 2025

The regulatory framework in Europe underwent significant tightening in 2025, driving operators to adapt their strategies. Germany increased its gross gaming tax from 5.3% to 7%, while the UK introduced age-specific stake limits – £5 ($6.30) for adults and £2 ($2.50) for those aged 18–24 – requiring operators to implement systems capable of differentiating by age. Denmark mandated B2B licensing, meaning operators can now only work with licensed suppliers. Italy raised licensing fees and taxes, with the additional revenue earmarked for addiction support programs. In the Netherlands, proposals for universal deposit and loss limits were coupled with strict advertising restrictions. Meanwhile, Malta is under pressure from the European Commission to require its licensed operators to comply with foreign court rulings, a move that could challenge the country’s longstanding legal protections.

France, on the other hand, is debating the legalization of online casinos to combat a €1.5 billion ($1.6 billion) black market. However, the proposed tax rate – 55.6% of gross gaming revenue – poses a significant hurdle, making profitability almost unattainable for many operators.

These sweeping regulatory changes are driving up compliance costs and creating new hurdles for operators across the continent.

Compliance Costs and Operational Challenges

With stricter regulations come higher financial and operational demands. Licensing costs vary significantly across Europe, creating a fragmented and expensive landscape. For example:

- Spain: An application fee of €38,000 ($40,300), plus €2,500 ($2,650) per additional license, and a €2 million ($2.12 million) guarantee.

- Malta: Requires a minimum of €100,000 ($106,000) in paid-up share capital.

- France: Expects operators to have over €1 million ($1.06 million) in capital.

- Germany: Capital requirements exceed €360,000 ($382,000), with approval times ranging from three months in Estonia to over a year in France.

Beyond these upfront costs, operators must invest heavily in RegTech solutions to meet compliance demands. These include tools for real-time risk assessments, automated Know Your Customer (KYC) checks, and monitoring player behavior. Spain, for instance, requires operators to use a .es domain and implement systems capable of tracking transactions, which must undergo certified technical verification.

The stakes for non-compliance are high. In March 2025, the UK Gambling Commission fined AG Communications Limited (operating as Aspire Global) £1.4 million (€1.70 million or $1.80 million) for serious breaches related to anti-money laundering and social responsibility. This case highlights the steep financial consequences of failing to meet regulatory standards, making proactive investment in compliance infrastructure a necessity rather than a choice.

Technology Driving Market Growth

As regulatory demands and market complexities grow, technology is stepping in with solutions that directly address these challenges.

AI and Automation in iGaming

AI tools are reshaping how operators manage players and meet compliance requirements. For instance, predictive analytics can assess thousands of behavioral markers in real time to identify signs of risky behavior. When these systems detect potential issues, they automatically initiate interventions like cooling-off periods or spending limits. This not only ensures compliance but also enhances player retention by prioritizing safety.

Smaller and mid-sized operators are also benefiting from AI advancements. Take InTarget, for example. Its AI assistant allows marketing teams to ask questions in plain English and receive instant, data-driven insights. This enables them to quickly adjust campaigns and launch targeted strategies. By processing real-time data, the platform personalizes promotions and risk alerts, turning ethical practices into a competitive advantage that boosts player loyalty.

Beyond AI, blockchain technology is playing a key role in improving operational transparency and efficiency.

Blockchain and Cryptocurrency Adoption

Blockchain is tackling operational friction by making transactions more transparent and auditable. This technology is helping to bridge the gap between online platforms and traditional land-based casinos, fostering trust in markets where consumer confidence is critical. In regions with unstable banking systems or among tech-savvy players, cryptocurrency-exclusive tables and blockchain-based games are becoming increasingly popular.

One of blockchain’s standout features is its ability to enable instant deposits and withdrawals, addressing delays that often frustrate players. With mobile gambling now accounting for over 58% of European online gambling revenue, users are seeking payment options beyond traditional credit cards. Operators are responding by integrating e-wallets and decentralized digital currencies, which offer greater privacy and faster transactions. Just as AI enhances risk management, blockchain strengthens operational reliability, even as regulations evolve. These advanced payment systems, combined with stringent European industry standards, make money laundering through regulated operators highly unlikely, reinforcing the sector’s security.

"Europe’s gambling market showed steady growth in 2024… online channels are showing stronger momentum, driven by changing consumer preferences and technological advancement." – Maarten Haijer, Secretary General, EGBA

Player Demographics and Behavior

Active Player Statistics

Europe’s online gambling market leans heavily toward younger players, with those under 35 taking the lead. For example, in France, 30% of online gamblers fall into the 18–24 age group. Meanwhile, in the UK, 55% of players are under 35. Spain’s largest demographic is the 25–34 age group, making up 35%, and in Italy, over half of active accounts belong to players aged 18–34.

These figures also shed light on spending habits. Online gamblers are 3.62 times more likely to be high spenders compared to those who gamble solely at land-based venues. Players who engage in both online and offline gambling are even more likely to spend, with odds 4.56 times higher than land-only gamblers. Additionally, high personal income is often linked to greater online gambling participation.

Motivations for gambling vary by region. In Spain, 44% of players are driven by the potential for profit, compared to just 15% in the UK. British players often cite the convenience of gambling from home, while Italians enjoy the thrill and the sense of team support. On the other hand, French players generally approach gambling as a casual and social pastime.

Understanding these demographics and behaviors is key to crafting strategies that resonate with each market. By tailoring campaigns to fit the unique preferences of players in different regions, operators can develop more effective customer relationship management (CRM) strategies and personalized marketing efforts.

Player Retention Strategies

With these demographic trends and spending habits in mind, operators are fine-tuning their retention strategies to strengthen player loyalty and engagement. For instance, they align content themes with local sports interests – horse racing in the UK and Italy, or ice hockey in Sweden and Finland. This localized approach not only attracts new players but also keeps existing ones engaged by offering experiences that feel relevant and familiar.

Mobile gaming is another critical area of focus. By 2024, 58% of gambling revenue is expected to come from mobile devices, a figure projected to climb to 67% by 2029. In the UK, the average session for online slots lasts 16–17 minutes, with 4.7–6.4% of sessions stretching beyond an hour. For smaller operators, advanced tools simplify player segmentation for iGaming. For example, they can identify players who have been inactive for 10 days and send targeted campaigns to re-engage them – no team of data analysts required.

These strategies highlight the importance of using player data to create tailored experiences, ensuring that operators stay competitive in an increasingly mobile-driven market.

Market Forecast: 2029-2035

Growth Projections Through 2035

The European online gambling market is on track for substantial growth in the coming years. Forecasts indicate the market will grow from $31.32 billion in 2025 to $80.13 billion by 2035, marking a compound annual growth rate (CAGR) of 9.85%.

Germany is expected to lead the way with a projected CAGR of 12.1% – the highest among major Western European markets. This surge is largely attributed to the recent legalization of online sports betting and casino games. France isn’t far behind with an anticipated growth rate of 11.0%, driven by expanded regulations around online poker and sports betting. Meanwhile, the United Kingdom, despite its status as a mature market, is expected to sustain steady growth at 10.0%, thanks to ongoing innovations by operators.

Online gambling is predicted to account for 45% of Europe’s total gambling revenue by 2029, up from 39% in 2024. Mobile devices are set to play a dominant role, contributing 67% of online gambling revenue by 2029, compared to 58% in 2024. The online casino sector alone is projected to reach $15.22 billion by 2033, with a CAGR of 11.34%. Within this sector, live-dealer formats are expected to grow the fastest, with an annual expansion rate of 13.8%.

These figures highlight a dynamic period ahead, marked by both technological advancements and regulatory shifts.

Expected Technology and Regulatory Changes

The anticipated growth will likely drive major changes in technology and regulations. The EU AI Act, expected to take effect by 2026, will introduce stricter requirements for platforms using AI. Operators will need to ensure algorithm transparency and undergo independent audits to demonstrate that their systems are free from bias and actively protect vulnerable users.

By 2027, new EU anti-money laundering regulations are expected to ban anonymous cryptocurrency accounts and privacy-focused coins like Monero and Zcash. This will require operators to adopt more rigorous identity verification processes to comply with the updated standards.

"The harmonization of regulations across EU member states may facilitate cross-border operations, potentially increasing market participation and revenue generation." – Market Research Future

Conclusion

The European online gambling market is on the brink of major growth. By 2025, revenues are projected to reach $55.2 billion, climbing to nearly $72.2 billion by 2029. Mobile devices are playing a crucial role in this expansion, contributing 58% of online revenue in 2024 and anticipated to grow to 67% by 2029. This makes mobile optimization a key focus for operators aiming to stay competitive.

With this growth comes tighter regulations. Germany, for instance, raised its GGR tax from 5.3% to 7% in 2025. Meanwhile, the UK introduced a $6.30 stake limit for online slots in April 2025, with a lower $2.50 limit for younger players aged 18–24. The UK Gambling Commission also fined AG Communications Limited (operating as Aspire Global) $1.70 million in March 2025 for failing to meet anti-money laundering and social responsibility standards.

Technology is reshaping how operators connect with players. AI-powered tools are improving risk detection, while live dealer formats are growing at an annual rate of 13.8%, enhancing the overall player experience. In the UK alone, customer interactions surged by 53% year-over-year, reaching 4.4 million in 2025. Smaller and mid-sized operators that embrace AI-driven retention strategies, offer localized payment options (like iDEAL in the Netherlands or Trustly in Sweden), and prioritize mobile-first experiences are better positioned to thrive in this competitive space.

"Looking ahead to 2025, we expect online gambling to cross the significant 40% market share milestone, with this trend projected to continue in the coming years as online gambling is expected to approach parity with land-based gambling by 2029." – Maarten Haijer, Secretary General, EGBA

FAQs

How will new regulations affect the profitability of online gambling operators in Europe?

The profitability of European online gambling operators is increasingly influenced by evolving regulatory landscapes. Governments across the region are stepping up rules around licensing, advertising, and consumer protection. As a result, operators are facing higher compliance costs. These costs often stem from the need to invest in legal expertise, implement robust anti-money laundering (AML) systems, and deploy comprehensive reporting tools – all of which can tighten profit margins.

Stricter advertising rules and the uncertainty surrounding new regulations also create additional challenges. These factors can restrict marketing efforts and delay the rollout of high-margin products, making it harder for operators to grow. On the flip side, when regulatory frameworks are clear and consistent, they can open doors to expansion. A case in point: Europe’s recent focus on regulatory clarity contributed to the region capturing 41% of the global online gambling market in 2024. Ultimately, the ability of operators to balance compliance demands with opportunities from well-defined regulations will play a key role in shaping their profitability.

How are mobile devices driving the growth of online gambling in Europe?

Mobile devices are driving the rapid expansion of Europe’s online gambling market. Experts anticipate that between 2025 and 2030, the mobile segment will experience the fastest growth. The reason? The unmatched convenience of smartphones and tablets, coupled with the growing popularity of immersive betting apps.

Take Denmark as an example: nearly two-thirds of last year’s 6.9% rise in gross gaming revenue came from mobile sports betting. This underscores how mobile-first habits are shaping revenue trends. Across Europe, better connectivity, intuitive apps, and platforms designed with mobile users in mind are encouraging players to move away from traditional gambling venues and embrace digital experiences, fueling steady growth year after year.

How are AI and blockchain changing the European online gambling market?

Blockchain is shaking up the online gambling world with the rise of crypto-casinos, where players can use digital currencies for everything from deposits to bets and payouts. Thanks to blockchain’s distributed ledger, transactions are not only faster and borderless but also come with a transparent, tamper-resistant record of every wager. This level of transparency fuels the demand for provably fair games while reducing dependence on traditional banking systems. To elevate the gaming experience, many operators are now incorporating blockchain wallets and smart contracts into their platforms.

On the other hand, AI is making waves by introducing smarter tools for player segmentation, real-time odds adjustments, and fraud detection. It helps operators deliver personalized experiences, streamline decision-making, and fine-tune marketing campaigns. Together, these cutting-edge technologies are reshaping iGaming, making platforms more efficient, secure, and tailored to players’ needs.