Player segmentation helps online casinos and sportsbooks categorize players based on behaviors like deposits, game preferences, and activity levels. This approach boosts retention and revenue by tailoring campaigns to specific player needs. However, poor data quality hampers 83% of companies, making reliable tools essential.

Two platforms dominate the space:

- InTarget: Designed for small to mid-sized operators, it offers easy setup (1 week), no technical expertise required, and starts at $825/month. With 50+ triggers and real-time updates, it simplifies segmentation for quick results.

- Enterprise Platforms (e.g., Optimove): Built for large operators, these tools provide advanced AI-driven segmentation but require months of setup, technical teams, and a $5,000+ monthly budget.

Key Takeaway: For smaller teams needing fast, straightforward solutions, InTarget is a better fit. Larger operations with complex needs may benefit from enterprise platforms but at a higher cost and complexity.

1. InTarget

Segmentation Capabilities

InTarget excels at delivering precise, data-driven segmentation tailored specifically for the iGaming industry. With this platform, you can fine-tune your player base into highly specific groups using filters that matter most. For example, you can segment players based on their transaction history – such as deposits, withdrawals, or crypto balances – along with key behavioral patterns like session duration, GGR (Gross Gaming Revenue), and even specific actions taken by players. The platform’s advanced AND/OR logic supports unlimited targeting criteria, making it possible to create segments like: "mobile sports bettors in New Jersey who deposited via crypto in the last 7 days but haven’t placed a bet on NFL games."

InTarget comes with built-in tracking for iGaming-specific metrics, including GGR, first-time deposits, win/loss ratios, and support for multi-currency wallets. Best of all, these segments update dynamically as new data comes in, ensuring your audience groups stay fresh and relevant without requiring manual updates.

Ease of Implementation

Getting started with InTarget is refreshingly quick – it can go live in about a week, compared to the months-long timelines typical for enterprise CRMs for iGaming. The platform offers free data migration and provides a dedicated Support Manager to guide you through the process. No need for SQL expertise or a specialized data team either; the built-in AI Data Helper allows marketing teams to ask questions in plain English – like, "Which players deposited over $500 last month but haven’t logged in this week?" – and get instant, actionable answers.

The user-friendly interface makes it easy to create segments, launch campaigns, and monitor performance. Over 100 iGaming operators have already adopted InTarget, with a 97% satisfaction rate reported in client surveys. Its rapid deployment empowers marketing teams to act quickly and run data-driven campaigns without delays.

Pricing and Affordability

Starting at $825 per month, InTarget is an accessible option for small to mid-sized operators managing anywhere from 500 to 150,000 monthly players. By combining CRM, email, SMS, and push notifications into a single platform, it eliminates the need for costly third-party tools. Plus, with over 50 behavior-based triggers – far surpassing the limited 5–10 triggers found in generic CRMs – you can automate campaigns more effectively without additional fees.

Impact on Campaign Metrics

In 2025, InTarget helped operators generate over $5.5 million in attributed revenue through its precise conversion tracking. By leveraging personalized segments built on RFM analysis and behavioral triggers, operators saw retention rates improve by 20–30%.

"Best investment we made this year, hands down. The ROI tracking alone pays for itself. We finally know which campaigns drive deposits and which don’t." – Daniel V, Casino Manager

Targeted campaigns powered by InTarget have also proven to cut wasted ad spend by 25–50% compared to generic mass promotions. With real-time dashboards, you can instantly see which segments are responding to specific offers, allowing you to fine-tune your strategy and maximize results.

2. Optimove and Other Enterprise Platforms

Segmentation Capabilities

Enterprise platforms like Optimove and Fast Track prioritize depth and complexity over speed and simplicity. These platforms leverage more than 20 AI models to analyze player behavior across large, multi-brand operations. Instead of relying on straightforward triggers like deposits or gameplay, they use methods like k-means clustering to create highly uniform segments. While this advanced approach can deliver precise targeting, it also introduces significant challenges in implementation and ongoing management.

Ease of Implementation

The sophisticated nature of enterprise platforms comes with a steep setup curve. Unlike simpler tools, these platforms require 3 to 6 months for full integration and demand the expertise of dedicated technical teams. The complexity doesn’t stop there – nearly half of organizations (49%) report struggling to integrate data across systems, and 53% cite outdated or overly complicated technology as a barrier to fully utilizing customer data for marketing. For operators without robust technical resources, this can slow down time-to-market and hinder revenue growth.

Pricing and Affordability

Enterprise CRMs come with a hefty price tag, starting at $5,000 per month, with custom pricing based on factors like personalization, traffic, and the number of active experiments. On top of that, hidden costs – such as implementation fees, ongoing maintenance, and the need for specialized staff – can significantly drive up the total cost of ownership. While a Forrester Total Economic Impact study highlights that Optimove can improve campaign efficiency by 88%, achieving this level of performance requires a substantial budget and strong technical infrastructure.

Impact on Campaign Metrics

When properly funded and staffed, these platforms can deliver impressive results, like an 88% boost in efficiency. However, they can also inadvertently lead to over-segmentation, which fragments marketing efforts and complicates scaling. Managing numerous micro-segments often requires dedicated teams to handle tasks like data cleaning, integration, and optimization. For mid-sized operations without these resources, the advanced features can quickly shift from being an advantage to a significant operational burden.

Advantages and Disadvantages

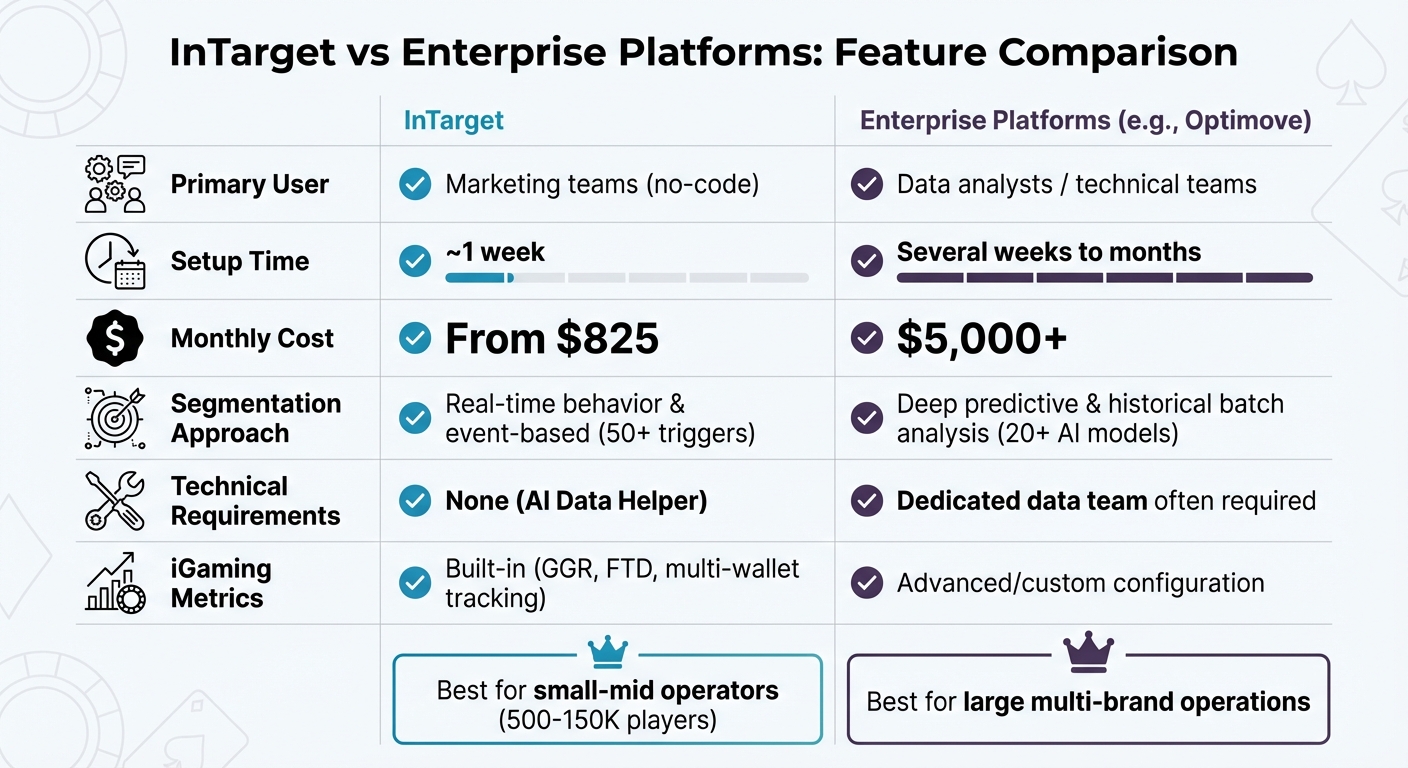

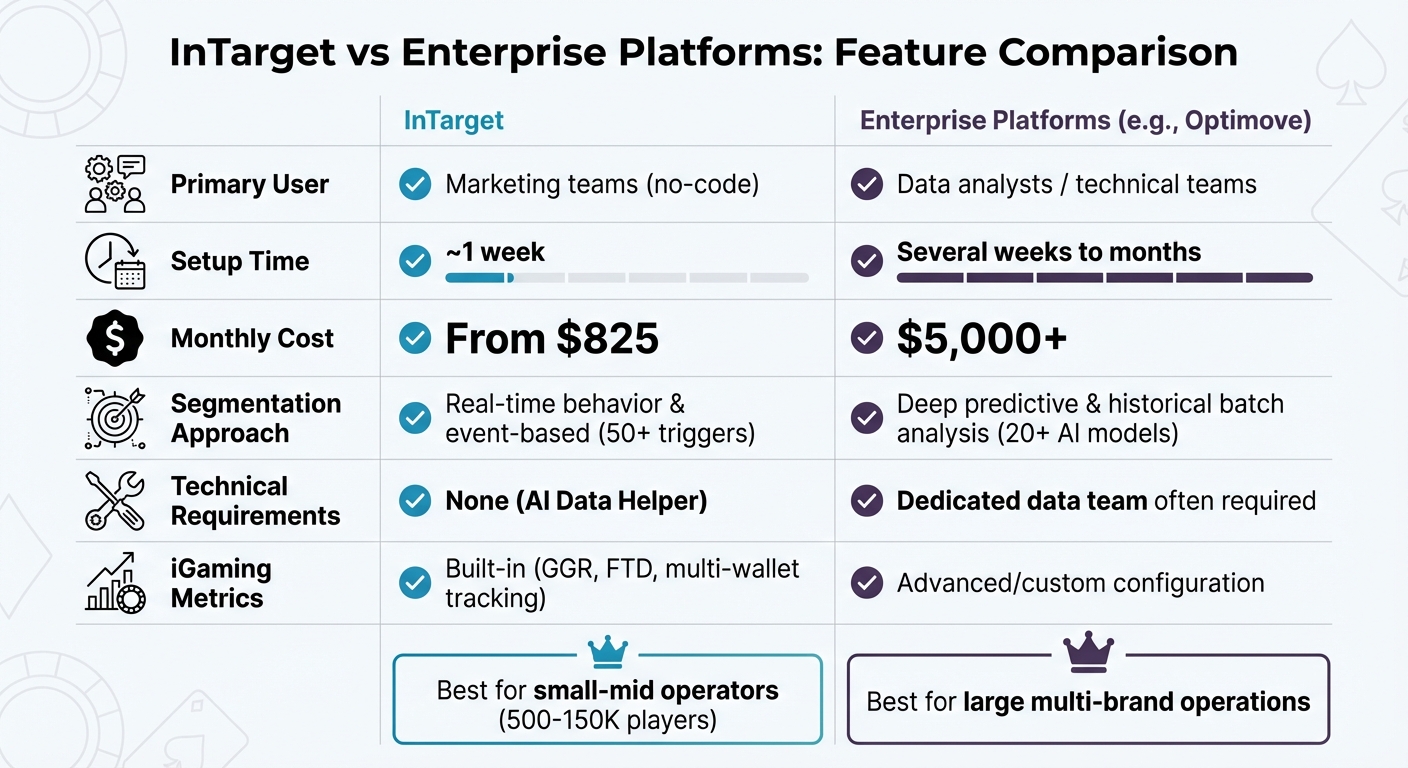

InTarget vs Enterprise Platforms: iGaming Segmentation Comparison

Selecting the right platform hinges on factors like your operational scale, technical expertise, and budget. InTarget, for instance, is designed with small to mid-sized operators in mind, especially those managing 500 to 150,000 monthly players. Its no-code setup emphasizes speed and simplicity, allowing the platform to launch in about a week. Plus, it includes free data migration and doesn’t require a dedicated data team. Marketing teams can use its AI Data Helper to create player segments through plain language queries – think something like, "Which players haven’t deposited in the last 10 days?" – eliminating the need for SQL knowledge. This makes it a great choice for quickly launching campaigns and tracking iGaming-specific metrics such as GGR, first-time deposits, and multi-wallet balances (real, bonus, and crypto).

On the other hand, enterprise solutions focus on depth and advanced capabilities rather than speed. Platforms like Optimove excel at predictive modeling and managing multi-brand operations. They use sophisticated AI models to forecast key metrics like churn, lifetime value, and product preferences, leveraging large datasets for deeper insights. However, these benefits come with trade-offs: setup can take weeks or even months, pricing starts at $5,000 per month, and integration typically requires a dedicated technical team. For operators without strong data resources, this complexity can create challenges – especially since 83% of companies report inefficiencies in segmentation due to poor data quality.

When it comes to pricing, InTarget offers a more budget-friendly alternative compared to enterprise platforms.

| Feature | InTarget | Enterprise Platforms (e.g., Optimove) |

|---|---|---|

| Primary User | Marketing teams (no-code) | Data analysts / technical teams |

| Setup Time | ~1 week | Several weeks to months |

| Monthly Cost | From $825 | $5,000+ |

| Segmentation Approach | Real-time behavior & event-based (50+ triggers) | Deep predictive & historical batch analysis (20+ AI models) |

| Technical Requirements | None (AI Data Helper) | Dedicated data team often required |

| iGaming Metrics | Built-in (GGR, FTD, multi-wallet tracking) | Advanced/custom configuration |

For smaller operators, platforms like InTarget are a practical choice, offering tools that prioritize action over complexity. Features such as 50+ behavior-based triggers and a visual campaign builder allow teams to act on player data almost immediately. In contrast, enterprise platforms often require weeks of setup before campaigns can even begin. If your operation doesn’t have a dedicated data science team or needs to stay agile in a competitive market, the accessibility and speed of InTarget may outweigh the advanced modeling capabilities of more complex enterprise solutions. Ultimately, the right choice depends on aligning the platform’s strengths with the specific demands of your operation.

Conclusion

Selecting the right segmentation platform depends heavily on your operational needs and the resources your team can dedicate. For operators managing between 500 and 150,000 monthly players who need quick, no-code solutions, InTarget stands out as a strong option. With a setup time of about one week and pricing starting at $825 per month, it eliminates many of the technical hurdles that can slow down marketing efforts. Its AI Data Helper allows team members to ask questions in plain English and receive instant insights into player behavior, making advanced segmentation more accessible.

For enterprises with more complex needs, platforms like Optimove cater to multi-brand operations requiring deep predictive analytics. These platforms are ideal for operators with the resources and technical teams to dive into detailed data analysis. However, for leaner teams or those operating on tighter budgets, such complexity might introduce unnecessary challenges.

InTarget boasts a 97% customer satisfaction rate, with notable success stories like this one:

"InTarget transformed our retention strategy completely. We increased player LTV by 35% in just 3 months." – Vlasta C, Head of Retention

InTarget’s speed and simplicity make it a great fit for growth-stage sportsbooks or online casinos aiming to optimize retention without the need for enterprise budgets or long implementation timelines. Its iGaming-specific features, such as GGR tracking, multi-wallet support, and crypto capabilities, set it apart from generic CRM platforms. On the other hand, enterprise platforms excel in offering advanced modeling and customization for operators managing complex, multi-brand ecosystems. The right choice ultimately depends on whether you value accessibility and efficiency or require deeper customization and analytics.

FAQs

What should I consider when choosing between InTarget and an enterprise platform for iGaming player segmentation?

When weighing your options between InTarget and an enterprise platform for player segmentation, here are some critical points to keep in mind:

- Budget and Simplicity: InTarget keeps things straightforward with transparent pricing tailored for small to mid-sized operators. There are no long-term contracts or hefty costs involved. On the other hand, enterprise platforms often require a much larger budget and come with intricate licensing structures that can add to the complexity.

- Ease of Use and Setup: InTarget is all about speed and simplicity. Marketers can easily create campaigns, segment players, and tap into AI-driven insights without needing technical teams. Plus, integration with iGaming platforms takes just a few days. Contrast this with enterprise platforms, which can take weeks to implement and often demand dedicated data teams for setup and maintenance.

- Scalability and Features: InTarget shines with practical tools like RFM segmentation and activity-based rules, making it a smart choice for operators looking for a fast return on investment. However, if you’re a large operator managing multiple brands or an extensive player base, enterprise platforms might be more appealing. They offer greater customization and scalability to handle complex infrastructures.

By assessing your operation’s size, budget, and priorities – whether it’s speed and simplicity or advanced customization – you can find the platform that aligns best with your goals.

How does InTarget keep player segments up-to-date and relevant?

InTarget keeps player segments up-to-date by automatically refreshing profiles using real-time data from websites, apps, and marketing platforms. Its dynamic segmentation engine monitors critical behaviors, such as game preferences, session lengths, and deposit patterns, ensuring segments adjust seamlessly as player activity changes.

On top of that, the integrated AI assistant delivers quick insights by answering questions rooted in the most recent player data. This allows operators to make informed decisions faster and with greater precision.

What challenges do smaller iGaming operators face when using enterprise platforms for player segmentation?

Enterprise platforms for player segmentation can offer robust capabilities, but they often pose significant challenges for smaller iGaming operators. These systems typically demand a dedicated team of data or analytics professionals to manage intricate segmentation rules. This not only drives up costs but also makes such platforms harder to use for marketers who lack technical expertise.

Another key issue is the lengthy onboarding process. Setting up these platforms can take weeks, requiring custom data integrations and extensive testing. This delays campaign launches and stretches the time it takes to see results. On top of that, the pricing structures often cater to high-volume operators, using tiered models that smaller casinos or sportsbooks simply can’t afford.

Then there’s the complexity of the platforms themselves. Their vast array of features usually comes with a steep learning curve, making it difficult for teams to handle tasks like creating segments or generating reports without relying on developers. This slows down the pace of experimentation and limits the ability to adjust quickly to new strategies.

Because of these hurdles, many smaller operators lean toward simpler platforms. These alternatives are designed to be easier to use, faster to implement, and more budget-friendly, making them a better fit for their needs.